Hedera became the unexpected star of the crypto market this week after jumping more than 7% on Tuesday, following the surprise launch of the first exchange-traded fund (ETF) directly investing in the digital coin.

ETFs Launch Amid Government Shutdown

In a move that caught much of Wall Street off guard, a few ETFs tied to smaller cryptocurrencies, including Hedera and Litecoin, were launched in the United States on Tuesday, even as the federal government remains partially shut down. The shutdown, which began on October 1, has left the U.S. Securities and Exchange Commission (SEC) operating only with essential staff, and reviewing ETF filings is not considered essential work.

Yet, Canary Capital, a relatively small asset management firm, successfully launched both the Canary Hedera ETF and Canary Litecoin ETF by using a legal technicality. The firm removed specific “delaying amendments” from its registration documents, which usually pause approval while the SEC reviews applications. Without those clauses, the filings automatically became effective after 20 days, clearing the path for launch.

Steven McClurg, chief executive and founder of Canary Capital, explained that the company made only minor wording adjustments to comply with the SEC’s existing rules. “We’ve gone back and forth with the SEC several times over the past year,” McClurg said. “I believe these ETFs would have been approved earlier if the shutdown hadn’t started.”

Hedera Takes the Spotlight

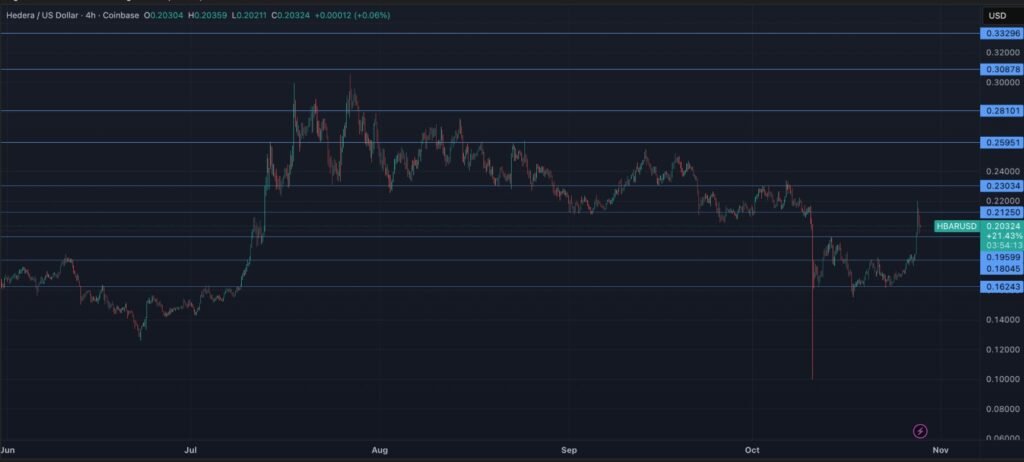

The result was immediate. Hedera’s price jumped more than 7% on Tuesday, signaling strong investor enthusiasm for broader exposure to smaller crypto assets. Litecoin, on the other hand, fell slightly, while Solana managed a 1.2% gain.

These new ETFs are the first of their kind to directly invest in smaller cryptocurrencies beyond Bitcoin and Ether. The timing was unexpected but strategically sharp. Canary’s quick action positioned it ahead of major firms like Fidelity, Invesco, and Franklin Templeton, which were awaiting regulatory decisions that were frozen by the shutdown.

Meanwhile, crypto asset manager Bitwise launched a Solana ETF the same day, and Grayscale is preparing to convert its closed-end Solana Trust into an ETF.

Regulatory Loophole Sparks Debate

The move by Canary and Bitwise to bypass normal SEC reviews has ignited a heated debate in the financial industry. Roxanna Islam, head of sector and industry research at VettaFi, said this step “marks a significant moment for the crypto ETF market.” She noted that it expands investor access to smaller crypto assets but also comes with high regulatory risk.

“This will be a significant step forward for crypto ETFs,” Islam said. “But skipping SEC review is risky, as the agency could later require amendments once normal operations resume.”

The SEC’s own shutdown guidance, issued on October 9, confirmed that companies could technically file amendments to remove delaying statements but warned that issuers “should consider carefully the risks of this course of action.”

How the ETF Rule Works

Under normal conditions, ETF issuers add a clause called a “delaying amendment” to their registration filings, which prevents automatic approval. This allows the SEC to review the proposal and provide comments. However, if a firm removes that clause, the registration automatically takes effect after 20 days, even without active SEC approval.

Here is a simplified look at how the process works:

| Step | Action | Outcome |

|---|---|---|

| 1 | ETF issuer files initial registration | Awaits SEC review |

| 2 | Adds delaying amendment | SEC can comment and request changes |

| 3 | Removes delaying amendment | Registration goes live after 20 days automatically |

| 4 | ETF can start trading | Subject to later SEC review if required |

By using this rule, Canary and Bitwise pushed ahead without waiting for the SEC’s reopening. This strategy may give them a first-mover advantage, though the SEC retains the authority to review or halt operations once government functions resume.

Investors React to Market Uncertainty

Crypto traders were quick to respond. Hedera’s market capitalization climbed above $3.5 billion, according to CoinMarketCap data on Tuesday afternoon. While that figure is far below giants like Bitcoin or Ether, the move signals growing demand for diversified crypto exposure through traditional investment tools like ETFs.

“Some investors are likely to jump right in,” Islam noted. “But many will prefer to wait for the SEC to reopen and confirm these approvals.”

Industry analysts also observed that the Trump administration’s more favorable stance on crypto regulation has encouraged asset managers to expand beyond mainstream digital assets. ETFs for coins such as Solana, XRP, Dogecoin, Aptos, and SEI are now being actively developed.

Still, risk remains high. If the SEC objects to the filings once it resumes full operations, it could request amendments, limit marketing activities, or even suspend trading.

Broader Market Reaction

Elsewhere in the crypto market, Bitcoin dipped 0.5% to $113,843, while the S&P 500 and Dow Jones Industrial Average ended the day slightly higher, reflecting a calm but cautious investor sentiment.

Matthew Hougan, chief investment officer at Bitwise Asset Management, said his firm has worked closely with the SEC for months on its Solana ETF and remains confident. “As an issuer, you need to march forward with your business plans despite the government shutdown,” he said.

VanEck, another major player, also moved to remove the delaying amendment from its Solana ETF filing, signaling that more issuers may follow Canary’s lead if the shutdown continues.

However, most large firms are expected to hold back until the SEC reopens, given the potential for post-launch complications.

What This Means for the Crypto Market

The debut of ETFs tied to smaller digital assets could reshape how traditional investors access the crypto market. By allowing exposure to coins like Hedera and Litecoin through regulated funds, the market becomes more approachable for institutions that prefer ETF structures over direct crypto holdings.

This week’s events show how innovation in finance can push forward even when regulators pause, but they also highlight the fine line firms must walk to stay compliant in a fast-changing market.

As for Hedera, the 7% rally reflects optimism that the coin could gain wider recognition beyond the crypto community. Whether that momentum holds will depend on how the SEC responds once it returns to full capacity.

In the meantime, investors appear eager to embrace new opportunities, even amid uncertainty. The question now is whether these early launches will pave the way for a new wave of crypto ETFs—or serve as a cautionary tale.

The crypto world is buzzing, and all eyes are now on the SEC’s next move. What do you think about the surprise Hedera ETF launch? Share your thoughts on social media and join the conversation.